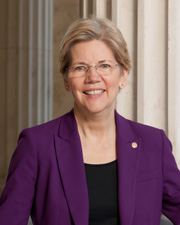

Elizabeth WARREN

Democrat · Massachusetts

Ranked #64 of 100 senators

Total Score60

Actions2

Avg/Action30.0

Era Comparison

Biden Term

Jan 2021 - Jan 2025

Score25

Actions1

Avg25.0

Trump 2nd Term

Jan 2025 - Present

Score35▲ 40%

Actions1

Avg35.0

Tactics Breakdown

EXTENDED DEBATE1 actions (35 pts)

Action History

Loading filters...

Thu, June 12, 2025

EXTENDED DEBATE35

GENIUS Act (stablecoin bill)

Senator Warren is delivering a lengthy opposition speech criticizing the GENIUS Act and Leader Thune's decision to move forward without amendments. While this consumes floor time, it appears to be substantive debate rather than pure obstruction.

View floor text

Mr. President, I rise today to talk about the GENIUS Act and the threat it poses to our financial system, our national security, and our democracy. Now, at this moment, I expected to be on the floor urging the Senate to adopt a series of amendments filed by both Democrats and Republicans, amendments that would fix the core problems with this bill. For weeks, Leader Thune promised that Senators would have a chance to vote on amendments on the stablecoin bill. Today, he broke that promise. This bill goes forward without a single chance for a single Senator to offer a single amendment. Even changes that have widespread, bipartisan support are left aside as Leader Thune decides just to strong-arm the bill on through the Senate. Now, before I outline the specific dangers posed by this bill, it is worth taking a step back to ask a simple question: Why is the crypto industry so vigorously lobbying for a bill that proponents claim will bring much needed regulation to the market? Simon Johnson, a Nobel Prize-winning economist, and Brooksley Born, the former Chair of the Commodity Futures Trading Commission, answered this question in a recent op-ed by reminding us that we have seen this movie before. Back in the late 1990s, derivatives were a relatively niche market, but a new type of product called an over-the-counter derivative had just been developed. Most investors didn't really understand what they were or what they did, but the derivatives industry came knocking, begging for so-called regulation. Congress was ready to oblige. In 2000, Congress passed the Commodities Future Modernization Act, and President Bill Clinton signed it into law. Proponents of the bill claimed that the new law would provide legal clarity, promote innovation, reduce risks, protect consumers, and advance U.S. competitiveness. After all, people said, surely some kind of regulatory framework was better than nothing at all. But the bill established a weak set of rules loaded with loopholes-- just as the industry wanted. Sound familiar? The result was a disaster. Derivatives moved from the edge of the financial system to the center of it. After all, with regulation, these derivatives now seemed to have the implicit blessing of the U.S. Government, and buying, selling, and designing derivatives became a more mainstream activity on Wall Street. In less than 8 years, the market for over-the-counter derivatives grew sevenfold and embedded itself into the core financial system. By simultaneously boosting the derivatives industry and lightly regulating it, the bill Congress had passed helped set the stage for the 2008 financial crash. After the meltdown, Congress came back and cleaned up the mess in Dodd-Frank, but that was long after hundreds of billions of dollars in taxpayer bailouts had been handed to Wall Street, while 10 million families had lost their homes and millions more had lost their jobs. Mr. Johnson's Nobel Prize is an impressive credential, and his warning should carry great weight. But we should also pay special attention to the thoughts of his coauthor Brooksley Born. She was one of the few people who saw the 2008 train wreck coming and opposed the derivatives bill at the time, and now she is ringing the alarm again. The parallels to the Commodity Futures Modernization Act are striking. Industry is the driving force behind the GENIUS Act. Proponents argue the GENIUS Act will provide legal clarity, promote innovation, reduce risks, protect consumers and advance U.S. competitiveness in a new financial market. Passage of the GENIUS Act is expected to significantly grow the market from $200 billion now to an estimated $2 trillion in a short time. And the GENIUS Act is riddled with loopholes and contains weak safeguards for consumers, national security, and financial stability. Yes, it all sounds very similar. But there is one big difference between the GENIUS Act and the CFMA: President Clinton did not own a derivatives company. President Trump does own a stablecoin company. Through his crypto business, President Trump has created an efficient means to trade Presidential favors--like tariff exemptions, pardons, and government appointments--for hundreds of millions, perhaps billions, of dollars from foreign governments, from billionaires, and from large corporations. This is the single greatest corruption scandal in American history, and by passing the GENIUS Act, the Senate is about to not only bless this corruption but to actively facilitate its expansion. The New York Times ran a front page essay this week by Ben Rhodes, President Obama's former Deputy National Security Advisor, on Trump's corruption. Rhodes interviewed Sandor Lederer, who heads a Hungarian anti-corruption organization and has witnessed the disintegration of Hungary's democracy under Viktor Orban. Lederer warned that ``the pressure corruption puts on a political system [is like] a river bearing down on a dam. Once the dam breaks, you're washed downriver by currents you can't control. If you try to rebuild the dam, it's too late.'' Instead of fortifying the dam, the Senate is now hacking away at it. In April, President Trump's crypto company, World Liberty Financial, launched its own stablecoin, called USD1. That stablecoin is already the fifth largest stablecoin in the world, and foreign investors have already begun to exploit this avenue for corruption. A UAE state-backed investment firm used Trump's USD1 to finance a $2 billion investment in a crypto exchange whose owner is reportedly lobbying President Trump for a pardon, essentially giving Trump a cut of this $2 billion deal. This is the model: Deposit your money in the ``Bank of Trump'' and use his stablecoin to make payments. He earns money by investing those deposits in other assets, like a bank, and also earns money on every transaction that occurs whenever the stablecoin is used as a means of payment. Even more publicized than his stablecoin, Trump launched a meme coin, another type of crypto asset. The coin was issued shortly before Trump's inauguration, and it initially soared in value. When people lost interest and the value of the coin began to sag, Trump launched a new scheme to make money. A few weeks ago, he hosted a dinner for the top holders of his meme coin, which, again, juiced the price and increased trade and volume. The meme coin has netted more than $320 million in transactions fees alone and has inflated Trump's net worth on paper by billions of dollars. And the favors for people who bought millions of dollars of Trump's coins have just begun. For example, one of those top holders at the dinner was crypto executive Justin Sun, who recently had his SEC lawsuit quietly dropped. Another was an investor with close ties to the Chinese Communist Party. There is nothing in the GENIUS Act to stop this corruption. In fact, the Senate bill would accelerate the corruption. The bill would expand the reach of USD1 and grow its size. It would make Trump the regulator of his own financial company, and, importantly, the regulator of his competitors. Senator Merkley is leading an amendment to fix this--an amendment that Leader Thune has blocked. There are other serious problems with the GENIUS Act--problems that Democrats and Republicans have amendments to fix. The bill permits Big Tech companies and other conglomerates to issue their own private currencies and take control over the money supply. It includes a special carve out that makes it even easier for private companies like X to issue a stablecoin. Musk has made it clear that, in a few years, he wants his new X Money payment platform to be ``half of the global financial system.'' Senator Hawley and Senator Blumenthal have an amendment to fix that. Leader Thune has blocked that amendment. Community banks have warned us that by creating a parallel, lightly regulated banking system, the stablecoin market will drain deposits from our local communities. There will be less funding available for small businesses and households all across our country. Senator Hickenlooper has an amendment to fix that. Leader Thune has blocked that amendment. The bill would also mean easier access to money for terrorists and cartels. Even today, the crypto industry's own analysts are calling stablecoins ``the new kingpin of illicit crypto activity.'' According to Chainalysis, a blockchain analytics firm, stablecoins account for more than 60 percent of all illicit crypto transactions. Unfortunately, the GENIUS Act massively expands the marketplace for stablecoins, while failing to address the basic national security risks posed by them. It also includes glaring loopholes that would allow Tether, a notorious foreign stablecoin issuer now based in El Salvador, access to U.S. markets. Just this week--just this week--prosecutors charged a Russian national in New York for using Tether to help Russians evade U.S. sanctions. Senators Schumer, Reed, Shaheen, and Blunt Rochester have amendments to fix those problems. Leader Thune has blocked those amendments. The bill also increases the likelihood that consumers will get ripped off and scammed in financial transactions involving stablecoins. It jeopardizes the CFPB oversight and the suite of consumer protections that people enjoy when they are using their Venmo app or an ordinary bank account. If you get cheated using a stablecoin, you may just be out of luck. The vast majority of stablecoin issuers won't even be required to undergo financial audits to make sure that they aren't committing fraud. Senators Durbin and Warnock have an amendment to fix this. Senator Thune has blocked that amendment. And, finally, the GENIUS Act lacks the basic safeguards necessary to ensure that stablecoins don't blow up our entire financial system. The bill permits stablecoin issuers to invest in risky assets and allows them to engage in risky, nonstablecoin activities, like private credit or derivatives trading. At the same time, the bill constrains regulators' ability to apply capital and liquidity safeguards to limit the chances of stablecoin failures. Again, we have amendments to fix this. And, again, Leader Thune has blocked those amendments. Over the past few months, Democrats seem to have forgotten that we actually have some power. This is an opportunity to use that power. Democrats can withhold their approval of this bill today and say that the bill will not go forward unless we have the opportunity to vote on some amendments, precisely as Leader Thune promised we could do. Democrats should show a little spine and insist on amendments as the price for helping advance this bill. We don't have to speculate on what could go wrong if this bill advances without changes. We have already seen it. The next time Trump is cut into a corrupt deal by a foreign government using his stablecoin or the next time North Korea uses stablecoins to add to its nuclear arsenal or the next time a person falls victim to a stablecoin scam or the next time the financial system is stressed by a stablecoin run, it is likely that the resulting harm will be traced right back to the inadequacies of the GENIUS Act. I urge my colleagues to vote no on this bill. The PRESIDING OFFICER. The Senator from Louisiana. Congressional Record, Volume 171 Issue 100 (Wednesday, June 11, 2025) American Energy